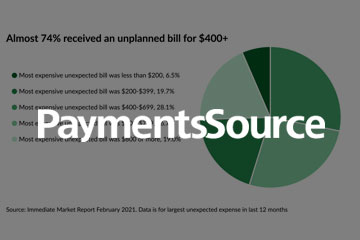

U.S. workers hit hard by expenses during COVID-19

Share This Post

More To Explore

Press Releases

Juvo Jobs and Immediate Partnership: Boost Hiring with On-Demand Pay

Birmingham, AL – July 24, 2023 – Juvo Jobs, the go-to platform for connecting employers with local job seekers, is thrilled to announce a new

July 23, 2024

Blog

Preserve Credit Health with On-Demand Pay

Empower your employees with Immediate’s on-demand pay solution, helping them safeguard their credit health by facilitating timely bill payments, managing emergencies without accruing debt, and

May 8, 2024